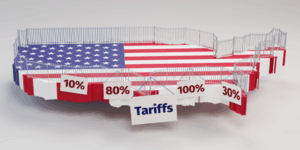

Tariffs, Trade Policy and What It Means for U.S. Credit Markets

The U.S. economy does not exist in a vacuum. International trade, tariffs and changing trade policies are powerfully influencing consumer behavior, corporate profitability — even the interest rate on your credit card. When trade tensions ebb and flow, credit markets often gyrate — and that can influence everything from lending rates to credit availability.

We’ll discuss how tariffs and trade policies affect U.S. credit markets, and what it may mean for financial institutions, consumers, and credit card holders in 2025 — and beyond.

What Are Tariffs and Trade Policies, Anyway?

Tariffs are taxes that one country puts on goods imported from another. When the U.S., for instance, issues a 20% tariff on Chinese steel, American importers pay that extra fee — and tend to pass along the cost to consumers.

Trade policy, by contrast, turns on a wider set of rules and agreements that determine how countries engage in business with one another. They decide whether trade is open and free or sheltered and curtailed.

Tariffs and trade policies are economic instruments of course: but they have a political weight too. There have been major shifts in policy in recent years — particularly where China, Mexico, the EU and Canada are concerned — affecting numerous industries and consumer prices.

How Broader Economy Is Affected by Tariffs

When tariffs rise, so do prices of imported goods. This can drive up inflation, particularly for goods that we use every day like electronics, clothing and food. If companies pass on these additional costs to consumers, household budgets can suffer.

Here’s how that plays out:

People can borrow more in order to preserve the old way of living, which also means they use a lot of credit card.

Hotter inflation, meanwhile, can force the Federal Reserve to keep or raise interest rates.

An uncertain business environment may mean more hesitation to invest or to hire and fire, as businesses look for greater certainty.” And that lack of confidence can feed weak demand.

Rising economic uncertainly causes credit markets to tighten. Lenders get more cautious, credit gets pricier and fewer consumers get favorable terms on a loan.

The Interconnectedness of Trade Policy and Credit Markets

Credit markets run on trust and predictability. Shocks in trade policies — such as the imposition of sudden tariffs or a collapse of trade agreements — create risk. Financial markets hate risk.

Here’s how the chain reaction unfolds:

Trade Tensions Increase Risk Premiums

Interest rates are also influenced by global instability, which lenders take into consideration. If trade wars endanger economic growth, then credit is more perilous and costly.

Tariffs Can Weaken Corporate Earnings

In hard-hit industries, those whose input costs are up or who don’t have an easy way to sell abroad may also make less money. That in turn makes them less appealing to bond markets and commercial lenders.

Inflation Expectations Affect Consumer Credit

The APR on a credit card is often linked to the prime rate, which is affected by inflation. Credit card rates could rise as a result of tariff-driven price hikes.

Investor Sentiment Turns Cautious

Bond markets could experience flight-to-safety flows, which would affect Treasury yields and other forms of credit.

In brief: “Trade policy uncertainty may also affect the cost and availability of credit for firms, impacting capital investment.”

Recent Cases: What History Shows

The U.S.–China trade war of 2018–2020 serves as an ideal test case. As the tariffs mounted, consumer goods prices rose and uncertainty pervaded global markets. The former fell as investors scrambled for safe havens and the latter widened, on account of fears of a recession.

During that period:

Credit card rates rose despite the Fed reducing its benchmark rate.

Consumer spending decelerated in important areas.

Auto loans and mortgages were slightly more difficult to secure in lower-income brackets.

The takeaway? Policy decisions that change tariffs can indirectly tighten consumer credit markets, in the presence of stable central bank policy.

What This Means for Consumers in 2025

Amid the current dynamic, the U.S. is taking another look at its relationships with key trade partners. Tariffs on Chinese goods remain in effect, and new ones have been proposed for industries including electric vehicles and green energy.

For consumers, this means:

Interest rates on credit cards may stay high. Even if inflation cools, global trade tensions could keep risk premiums elevated.

Balance transfer offers may shrink. Generous offers are often dialed back by credit card providers in times of uncertainty.

Lenders may tighten standards. Banks could also approve fewer credit card or loan applications if they anticipate slower economic growth as a result of trade disruption.

What Can Cardholders Do?

Although consumers have no say in tariffs or trade policies, they do have a say in managing their credit:

Lock in Lower Rates Now

If you’re carrying a balance or if making a big purchase is on the horizon but you’re short on cash, consider locking in a 0% intro APR card or fixed-rate personal loan.

Build Your Credit Score

Better deals are available with a higher credit score, even when markets tighten.

Watch for Inflation-Protected Rewards

Use cards offering cashback or rewards on essentials (groceries, gas — the categories that are likely to take the hit from price increases due to tariffs).

Monitor Credit Market Trends

Keep up with Federal Reserve action, inflation readings and trade negotiations. These factors shape lending terms.

What’s Next: Credit Markets in a New World

If we think it’s not cool that the president has so much power on trade, maybe that means … I don’t know, watching for what happens after 2024. From the promotion of domestic manufacturing to renegotiation of global trade deals, these actions are going to set the credit landscape in 2025–2026.

The banks, the regulators and consumers all should be paying close attention.

Conclusion

Tariffs and trade policy may seem far away, some geopolitical abstraction with little direct impact on your wallet. These macroeconomic factors can have a domino effect across the financial system, from higher credit card APRs to tightening loan qualifications.

Knowing how they work — and how they impact credit markets — can help consumers make smarter borrowing decisions, particularly in times of economic uncertainty.

So if you’re about to make a big purchase or just want to maximize your credit card strategy, keep tabs on what’s going on in Washington and the rest of the world. Because when tariffs rise, so may your interest rates.

Our Post

The Digital Frontier: How CBDCs Are Reshaping World Finance in 2026