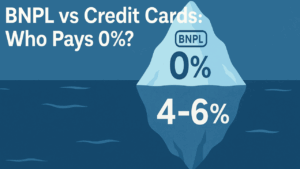

Are BNPL Transactions Still Worth It in 2025? Buy Now Pay Later vs. 0% APR Credit Cards: A Comparison

Which Payment Option Saves You More in 2025?

In recent years, Buy Now, Pay Later (BNPL) had a meteoric rise that is simply the easiest way to spread out a purchase over smaller, interest-free installments. But with the financial landscape of 2025 changing—inflation, consumer debt GROWING, and new credit card offers about to hit—you need to ask, are you still getting the best deal with BNPL? Or did 0% APR credit cards become the solution big time?

In this article, we outline BNPL in 2025 and compare the costs with the best 0% APR credit card deals available today, ready to help you choose between these two methods of approaching spend.

BNPL: What Is It and How Does It Work in 2025?

The third factor is BNPL, or buy now pay later, which allows you to break a purchase — usually at checkout — into equal payments across weeks or months. The BNPL landscape remains dominated by services like Affirm, Klarna, Afterpay and PayPal Pay in 4 and does not appear to be slowing, especially with online shopping and retail chains 꾸준한 assertion.

Most BNPL plans offer:

4 installments every 2 weeks (Pay in 4 model)

Financing with or without interest or fixed fees for periods of 3 to 24 months

Get approved on the spot with soft credit checks, or none at all

No annual fees

Again, BNPL is popular for purchases below $1,000, particularly among Gen Z and Millennials in 2025. However, thanks to increased prevalence — particularly among borrowers with more than one BNPL loan — this trend comes with an increasing number of pitfalls: hidden fees, credit score hit, and overextension.

What’s Changed in 2025? BNPL Risks You Should Know

Disclosures, Credit Reporting, and Borrower Protections

The Consumer Financial Protection Bureau (CFPB) issued guidelines in early 2025 making BNPL providers more transparent, strengthening credit reporting, and creating additional borrower protections, including these:

And while this is a step in the right direction, the fact is:

Failed payments might even impact your credit score

BNPL still leaves sticky returns and fights to have with retailers

There are no incentives for BNPL users

More late fees — and higher fees for longer-term BNPL loans

In an economy with persistently high costs of living, an increasing number of users are falling behind on multiple BNPL arrangements — in some cases with a lack of awareness as to what they owe. Which is driving a lot of folks back to more traditional financing options — namely, 0% APR credit cards.

What Is a 0% APR Credit Card?

A 0% APR credit card charges no interest on purchases, balance transfers, or both for an initial period of time—usually between 12 and 21 months.

Here’s what you can expect:

0% interest promotional period (e.g. 15 months on purchases)

Chance to reduce debt with no interest fees

Depending on the card: rewards and cash back

All the protections of a credit card (fraud cover, dispute mechanisms, etc.)

Although 0% APR cards demand a good to excellent credit score (approximately 740+), they afford much more control of big purchases and extended repayment flexibility

A Side-by-Side Comparison of BNPL vs. 0% APR Credit Cards

| Feature | BNPL | 0% APR Credit Card |

|---|---|---|

| Credit Check | Often none or soft | Full credit check required |

| Approval Time | Instant at checkout | Online or in-app, it takes about 5–10 min |

| Interest | Often none (short-term) | Intro APR of 0%, then normal APR |

| Repayment Terms | 4–6 weeks or 6–24 months | 12–21 months intro period |

| Purchase Limits | Usually up to $1,500 | By credit limit (usually higher) |

| Perks | None | Points, cashback, travel protection |

| Late Fees | Increasing in 2025 | Varies, but can be avoided |

| Impact on Credit | Growing in 2025 | Positive/Negative credit data |

| Ideal For | Small purchases | Big expenditures, variable budget |

BNPL – When It May Be the Better Choice Anyway

But BNPL may still have its place in limited circumstances, such as if:

You are spending less than $500

You are not eligible for a credit card or choose to not get one

You know that you can pay back in 4 to 6 weeks

You want instant cash without any credit check

Exclusive BNPL plans with no fees and no hidden terms from retailers may also work for financing very short-term.

But don’t go layering BNPL spending from different services, because there’s no built-in reminder, making it easy to forget a due date when payment schedules come from different apps.

The Best Time to Use 0% APR Credit Cards

In 2025, a 0% APR credit card could be the better tool if:

Your goal is to spend more (e.g. $1000+)

Desire for a longer repayment period (up to 21 months)

Wants to consolidate credit card debt

Cash back or travel rewards, value rewards

You are looking for improved fraud coverage and dispute resolution

For example, say you want to buy furniture, appliances, or take a trip — a 0% APR card offers more breathing room and flexibility (with no interest) as long as you pay it off within the length of the promo period.

Best Credit Card Offers – Preview of June 2025

Wells Fargo Reflect® Card

Introductory APR of 0% for 21 months on purchases and balance transfers

$0 annual fee

Best for: Long-term payout strategies

Chase Freedom Unlimited®

15 months at a 0% APR for purchases

1.5% unlimited cash back on every purchase

Intro bonus: $200 after you spend $500 in 3 months

Citi Simplicity® Card

0% Intro APR on purchases for 18 months

No late fees or penalty APR

Best suited for a large one-off purchase

Bottom Line: Go with Whatever Suits Your Style of Spending

Even in 2025 it stays simple for low dollar, temporary buy now, pay later type of transactions, assuming we are still reluctant to go as far as opening a fresh credit line.

0% APR credit cards, however, provide greater flexibility, rewards, and security, making them more appropriate for bigger or ongoing expenditures — if you can or adhere to on-time payments.

Many people new to these products might find both make sense: BNPL for the smaller, more predictable purchases; and a 0% APR card for larger purchases with a planning for payoff.

Just make sure you don’t fall into the pitfall of overcommitting on either side. Because debt is debt, be it through BNPL or a trusty credit card, and the principles of good debt management remain the same.

Our Post

From Paycheck to Prosperity: The Ultimate Blueprint for Sustainable Wealth Building